On Friday, July 4, 2025, the Central Bank of Nigeria (CBN) addressed speculations about fees for the Non-Resident Bank Verification Number (NRBVN) platform, launched in May 2025 with the Nigeria Inter-Bank Settlement System (NIBSS). Mrs. Hakama Sidi Ali, Acting Director of Corporate Communications, clarified that regular BVN enrollment for Nigerians in Nigeria remains free, while the $50 fee (approximately ₦80,000, as noted in X posts) applies only to diaspora Nigerians using the NRBVN platform. This fee, a significant reduction from the previous $200 charged for similar services, covers remote biometric capture, due diligence, and secure technology infrastructure, not the BVN itself. Ali dismissed social media claims of hidden or excessive charges as “inaccurate and misleading,” urging the public to verify information via official CBN and NIBSS channels.

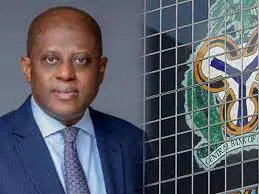

The NRBVN platform, accessible via www.nrbvn.ng, enables diaspora Nigerians to enroll for a BVN remotely, open domiciliary accounts in USD, GBP, EUR, or NGN, and access financial services like remittances, investments, mortgages, and pensions without traveling to Nigeria. Requiring documents like a valid ID, proof of residency, and KYC materials (e.g., utility bills), the platform uses robust Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols, issuing an NRBVN within 72 hours of approval. CBN Governor Olayemi Cardoso described it as a “milestone” for financial inclusion, targeting $1 billion monthly remittances (up from $4.73 billion in 2024) by streamlining access and reducing costs.

Leave a Reply